In its latest monthly report, Institute Director Bassam Fattouh and analyst Andreas Economou wrote: “As we enter 2022, the US shale response becomes a major source of uncertainty amid an uneven recovery across shale plays and players alike. As in previous cycles, US shale will remain a key factor shaping market outcomes.”

With global crude prices heading back toward $70 a barrel, the financial pressures on US shale have eased, and producers have adapted to the constraints of lower demand. “There has been a shift in perceptions about this sector’s behavior. There is a widely held belief that US shale producers have endorsed the principle of capital discipline,” the authors said.

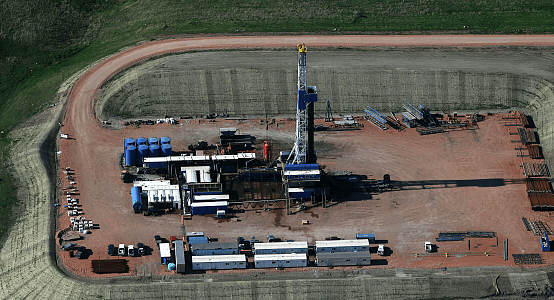

The key “rig count” — the number of drilling operations in progress on shale fields — is set to rise to 602 by the end of the year, a big jump from the 13-year low of 222 rigs last summer. While the direct relationship between rigs and production is complex, the authors concluded that rising shale output could affect the careful calculations of OPEC+, the producers’ alliance led by Saudi Arabia and Russia, to balance the global market.

“Unless demand underperforms relative to current expectations, an increase in US shale output of 0.95 million barrels per day could be absorbed, though this would reduce the overall supply deficit to 0.66 million. If the US shale growth hits the upper bound of 1.22 million barrels per day and demand recovery turns out to be slower than expected, then US shale could disturb the rebalancing, flipping the market into a surplus in Q4 2022,” the report added.

Photo source: picture from an open source